Peer-to-fellow (P2P) credit hinders having fun with a vintage lender otherwise credit partnership. If you’re in the market for that loan, it’s value contrasting P2P lenders since you research rates. P2P financing costs can be surprisingly reduced, particularly when your credit rating is great, plus the software processes tends to be smoother than you’ll feel whenever borrowing from the bank off a timeless financial. Even with reduced-than-primary borrowing, you could possibly become approved to own an inexpensive mortgage with this on the web lenders.

What is actually P2P Credit?

P2P funds try finance that folks and you may investors create-once the distinguished of financing that you get from your own financial. People who have readily available currency give so you’re able to provide it to people and you may companies thanks to on line properties. A good P2P provider (normally an internet site . or mobile app) was a main areas complimentary loan providers and you may consumers, making the techniques relatively simple and you will effective for all involved.

Advantages of Credit Having P2P

Low rates: You might have a tendency to borrow from the apparently reduced costs playing with P2P loans. Finance companies and you may borrowing unions have to shelter over costs for branch networks, other lines away from company, and you can a massive staff. P2P borrowing from the bank is much more streamlined and you will typically digital-indigenous, leveraging finest the newest technology. For this reason, the cost structure is more enhanced than simply that old-fashioned loan providers. P2P credit is frequently a much better bargain than having fun with a cards card, but it is usually wise examine cost. Because you exercise, listen to advertising pricing, to check out how quickly possible pay-off your debt.

Origination fees: You might have to pay an upwards-front side origination fee of 1% to eight% to cover the loan having good P2P financial. You to definitely charges depends on extent your use, so a beneficial $step one,one hundred thousand loan you will bear a great $fifty fee, to have examplepared into the price of a personal bank loan during the a great lender, this type of fees can be highest. On top of that, you would pay a great deal larger origination percentage having one minute home loan, therefore the personal bank loan techniques could be better to browse. Definitely, you’d shell out most fees to possess issues such as later money.

Simple and fast: Finding finance due to old-fashioned streams try a hassle, and you can when you pertain, you may need to endure an extended waiting for the approval techniques. Taking out fully P2P loans can also be ease a few of one serious pain. The program processes is typically quick, and you can usually see out relatively easily even when the loan is eligible. Genuine money might take more or less a week (because the dealers like whether to set currency on the the loan). Decisions try all the more quick, once the non-lender lenders on the web fund fund due to the fact large dealers.

Credit things, but imperfections is actually okay: From inside the a world where lenders was reluctant to lend to help you somebody with bad scratching to their credit history, P2P lenders continue to be a stylish option. You may need decent borrowing to locate recognized-a great FICO score from the mid 600s or more is the greatest-but P2P you are going to present significantly more possibilities than are offered close by. Including, Upstart means a minimum FICO or Vantage score regarding 620 to be eligible for that loan, whether or not some body as opposed to significant credit rating can also meet the requirements. The tough your borrowing from the bank condition are, the greater number of this type of finance costs (in the way of high interest levels), but that’s possible with a lot of loan providers.

Types of Money

P2P finance began as the personal unsecured loans-you might use for court objective, and you did not have so you can vow security discover recognized for a loan.

Signature loans will still be the most popular P2P funds, and so are also the extremely versatile. (Play with our very own calculator less than to find out how big mortgage renders sense to you.) You need utilize the currency with the debt consolidating, a special auto, renovations, otherwise doing a corporate. When you need to acquire to possess higher education, ensure even in the event your financial permits borrowing for the specific goal. College loans might be a far greater selection for financial aid anyway.

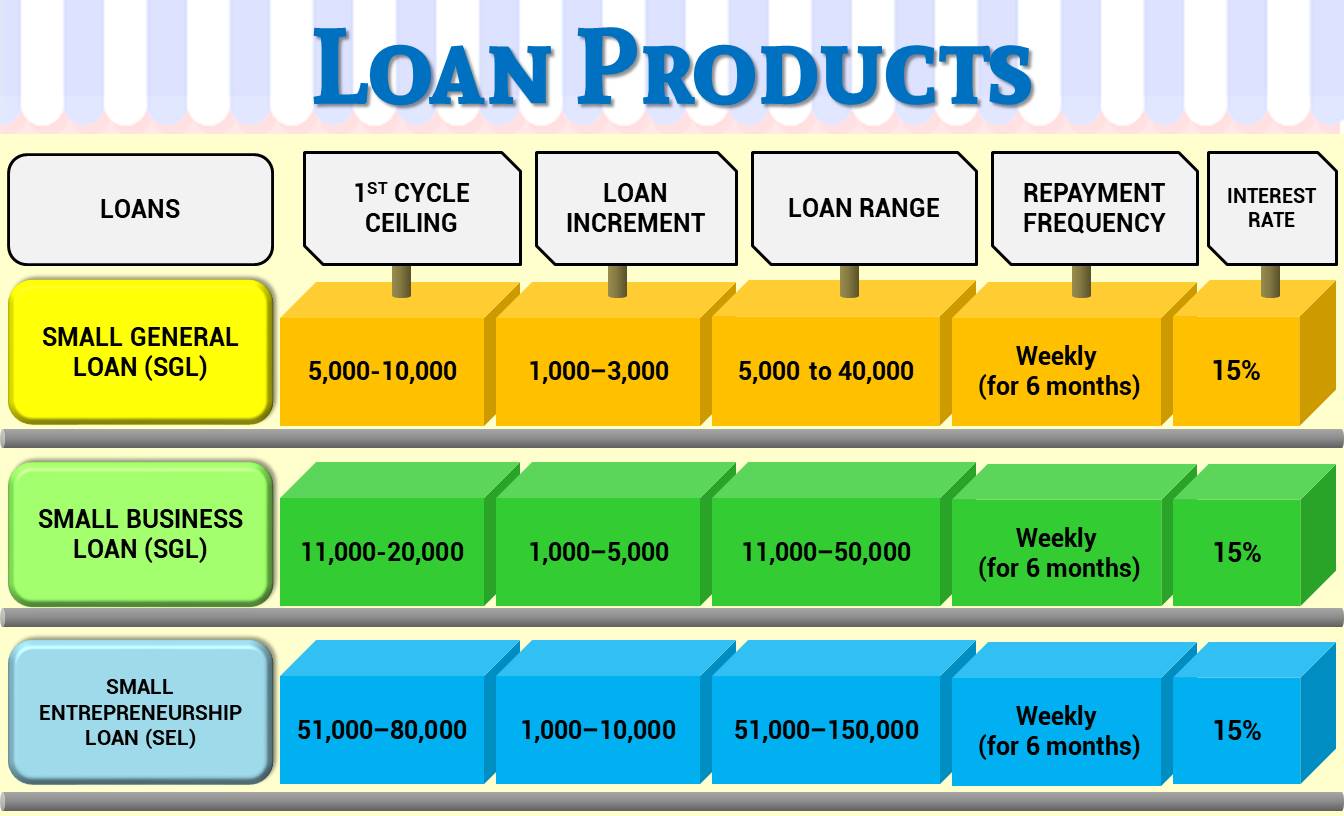

Authoritative P2P loan providers now offer money to own certain uses (such as for instance home business loans or virility procedures) in addition to loans to secure which have guarantee.

Well-known P2P Loan providers

The menu of P2P alternatives is consistently increasing. P2P money shot to popularity with Do well and you can LendingClub, both of and this nonetheless bring fixed-price loan choice. While you are heading the new P2P loan station, it should be value providing a bid in one of those a few sources (together with examining rates regarding others, if you prefer). Make sure you lookup people financial on the radar, and study product reviews off reputable sources before you apply for a financial loan. To borrow, you need to give delicate information like your Personal Cover matter, and you also don’t want to bring one information to a personality burglar.

Some other https://availableloan.net/personal-loans-mo/philadelphia/ a beneficial choices are readily available. Specific might not be pure P2P lenders-these firms are not individuals, but they commonly conventional bank lenders both. Numerous traders finance these types of online loans, while the money could even result from finance companies (without the old-fashioned bank-borrowing experience).

How it functions

To borrow cash thanks to a beneficial P2P mortgage, pick a lender and begin the program procedure. Your normally have to bring information regarding on your own, as well as the bank will get request your agreements for money. Really funds is signature loans, however loan providers can get promote certified packages so you’re able to finest serve you (including mortgage bundles having renovations otherwise debt consolidation, particularly). The financial institution checks their borrowing, so if you’re qualified to receive this service membership, investors can fund the mortgage.

With many P2P loan providers, you may need to wait a little while having resource. The method takes several days otherwise a few weeks. If your loan is actually funded, obtain the bucks digitally and you may pay the mortgage using automatic lender drafts.

You normally pay more 3 to 5 ages, you could always prepay without any punishment, that helps it can save you cash on attract.

Credit scoring: Punctual repayment in your financing generates your borrowing from the bank. Most lenders statement your activity to credit agencies, which will help you borrow on better conditions subsequently. But not, when you find yourself likely to later costs or standard towards the mortgage, the borrowing from the bank are affected. It’s vital to build money a priority and talk to the lender for folks who slide towards hard times.

Could it be Secure in order to Acquire That have P2P?

Data: Depending P2P lenders should protect your details while the securely just like the one almost every other lender carry out, and all sorts of interaction will be occur as a consequence of an encoded internet browser example otherwise application. Ergo, consider the data shelter standards when you see your own P2P lender.

Privacy: Your label is going to be left hidden out-of individual loan providers, but remark privacy formula carefully to know what information buyers have a tendency to found.

Rates: Interest levels are generally as nice as those people you will find somewhere else. You can likely shell out faster with P2P financing than simply you’d with a quick payday loan.

If you get financing that have a changeable rate, remember that rates normally go up. Whenever they do, their fee increase.